Turn success into savings

Increasing contributions on a regular basis – say, on the job anniversary date, the New Year or birthday – could make a big difference at retirement time. If this is implemented habitually, there may be a significant boost to your account value at retirement.

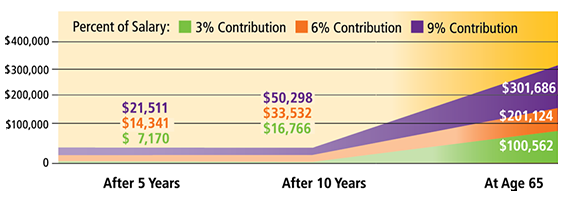

The chart below shows a hypothetical example of how higher contribution levels can increase retirement-age account values.

Values are for illustrative purposes only to show the general advantages of tax deferral and not reflect the performance of any particular funding option(s). Assumes a starting age of 35 years old with a starting account value of $0 and a salary of $40,000, paid biweekly, with a 6% net average rate of return, compounded annually. The actual rates of return for the periods shown will vary. Account values are not adjusted to reflect income taxes, product charges and fees or inflation, all of which will reduce the amounts available as retirement income. There is no guarantee that a retirement savings program will create the results shown.

Compare what might happen to the potential retirement nest egg – if the current contributions are left as is or if it is raised.