No matter how diligently individuals saved for retirement, they may encounter life events that compel them to think about "taking a break" from saving. Such events might include a financial hardship, a home purchase or college bills.

While borrowing from the retirement plan may seem like the perfect answer present needs, it may be at the expense of individuals' future. Here's an example of how even a short break from saving can have a long-lasting impact on your savings.

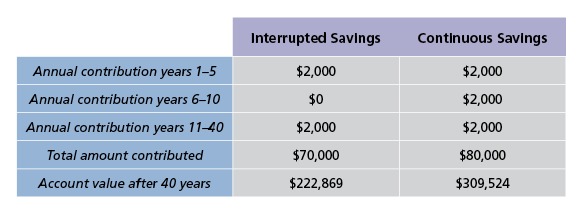

Meet Michael. He started off strong, contributing $2,000 a year to his retirement plan for five years. But then, for a range of reasons, he took a five-year break from contributing. After that, he was back on track – but that interruption cost him dearly. Over a 40-year period, he had contributed only $10,000 less due to the interruption – but his retirement nest egg was over $86,500 smaller.