Tiny steps can make a difference

It doesn't take a lot to start saving. And every dollar may make a difference in the long run. Remember that the amount contributed is pre-tax, as are any earnings, so it's all there to grow.

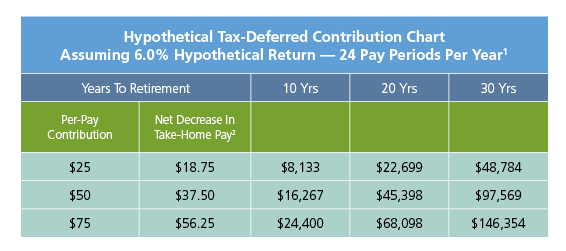

In the chart below, notice how a $25 contribution per paycheck sustained for only 10 years, can hypothetically generate retirement savings of $8,133.1 By raising this per-paycheck contribution to $50, the hypothetical savings could be $16,267 over the same period.

1 Values assume 6% effective annual interest rate. Contributions are assumed to occur at the end of each pay period.

2 Net decrease in take-home pay is based on a 25% Federal tax bracket. Individuals' tax bracket may be different. This illustration does not deduct any state or local taxes, nor does it account for fees and charges that may be imposed by the retirement plan. If those items were included, performance would be lower.

This illustration is hypothetical and not based upon any specific investment or MetLife product. Investors should consider his or her current and anticipated investment horizon and income tax bracket when making an investment decision, as the illustration may not reflect these factors. Any distribution is subject to ordinary income taxes upon receipt. A distribution prior to age 59½ could result in an additional 10% tax on income.