Save for retirement: The earlier, the better

If individuals haven't begun saving through their employer's retirement savings plan, it's wise to start right away. The power of compounding can be impressive, but it takes time for it to do its work. Waiting to start can be crucial.

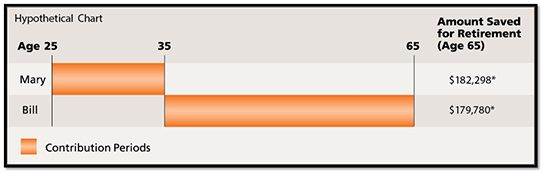

To understand why, let's compare two investors:

MARY gets an early start. At age 25, she starts investing $2,000 a year in her employer's retirement plan, and then invests nothing after age 35. By age 65, the total amount she has contributed to her employer's retirement plan is $22,000.

BILL starts later. He waits until he's 35 to invest the same $2,000 a year and contributes every year through age 65. By age 65, the total amount he has contributed to his employer's retirement plan is $62,000.

Since Bill has contributed nearly triple the amount Mary has, but will have much less in retirement savings.

Assuming both Mary and Bill earned a 6% annual rate of return, at age 65 Mary's nest egg will be over $2,500 more than Bill's.* Her early start put compound earnings to work for her sooner.

*Assumes 6% annual return and contributions are made at the beginning of each year. Annual earnings will fluctuate and could even be negative for some investments. Past performance is no guarantee of future results. Figures are for illustrative purposes only and do not indicate the future performance of any plan funding option(s). Investors should consider his or her current and anticipated investment horizon and income tax bracket when making an investment decision, as the illustration may not reflect these factors. Distributions prior to retirement age (e.g., 59½ for 403(b) and 70½ for 457(b) plans) are generally prohibited. Retirement savings program distributions are subject to your plan's restrictions and generally taxed as ordinary income tax in the year of distribution. For 403(b) and 401(k) plans, distributions before age 59½ may be subject to an additional 10 percent tax penalty, unless an exception applies. Since the plan is designed primarily to help employees save for retirement, federal tax rules restrict when money may be withdrawn from your account before you retire. Individuals should consult their tax advisor to determine whether an exception to these tax rules may apply.